Grafe and Irigoin’s revisionist take on the political economy of the Spanish Empire does not stand up to much scrutiny.

Revising our assessment of the Spanish empire is in vogue among economic historians. Most notably, Regina Grafe and Alejandra Irigoin (2006; 2008) have sought to revise the nature of the empire’s political economy. Their goal is to refute those who claim that the wealth gap between Anglo and Latin America today is due to the ‘extractive’ institutions established by the Spanish in their colonies compared to the more ‘inclusive’ institutions established by the British (e.g. North, Summerhill & Weingast 2000; Engerman & Sokoloff 2011; Acemoglu & Robinson 2012). While critiques of such deterministic narratives should be welcome, Grafe and Irigoin’s argument unfortunately rests on a misreading of their own data.

In their most important work, Grafe and Irigoin’s (2006) key empirical finding is that in the late eighteenth century funds tended to flow from Spanish American treasuries in the Interior to treasuries at the ports. They take this as evidence that the Spanish Empire ‘was not a system primarily aimed at the extraction of resources or revenues from the colonies for the benefit of the metropolis. Instead it successfully aimed at making the colonies self-sufficient, with intra-colonial transfers covering the needs of regions that either could not or would not raise sufficient revenue’ (Grafe and Irigoin 2006, p. 263).

Grafe and Irigoin found this pattern through a regression analysis of the accounts of 60 Spanish American imperial treasuries during 1785-89 and 1796-1800, which were collated by historians from the summaries of the imperial accounts that were produced for the king. Using each treasury’s net transfers to other Spanish American treasuries as the dependent variable, Grafe and Irigoin looked at various independent variables to explain why treasuries sent and received more or less.

In their own words, the significant receipt of funds by the ports was their most important finding:

The really striking result is that maritime ports received huge net transfers, about 350,000 pesos on average, when the average net income of cajas in this period was about 770,000 pesos [during the period 1785-89], albeit with tremendous variations. Moreover, it seems that ports attracted intra-colonial transfers essentially due to their commercial role. These results also hold true if we include, as an additional variable, transfers to the metropolis […]. Those districts that transferred funds to Spain received smaller net intracolonial transfers. The coefficient is not large, but it illustrates that the system of intracolonial transfers functioned largely independently of transfers to Spain, which were not a pivotal part of the redistribution of resources. (Grafe & Irigoin 2006, p. 256)

According to their analysis, then, the Spanish Empire was not extractive because those treasuries that were remitting funds did not receive transfers from other treasuries. Rather, intra-colonial transfers sought to promote trade by send funds to the ports.

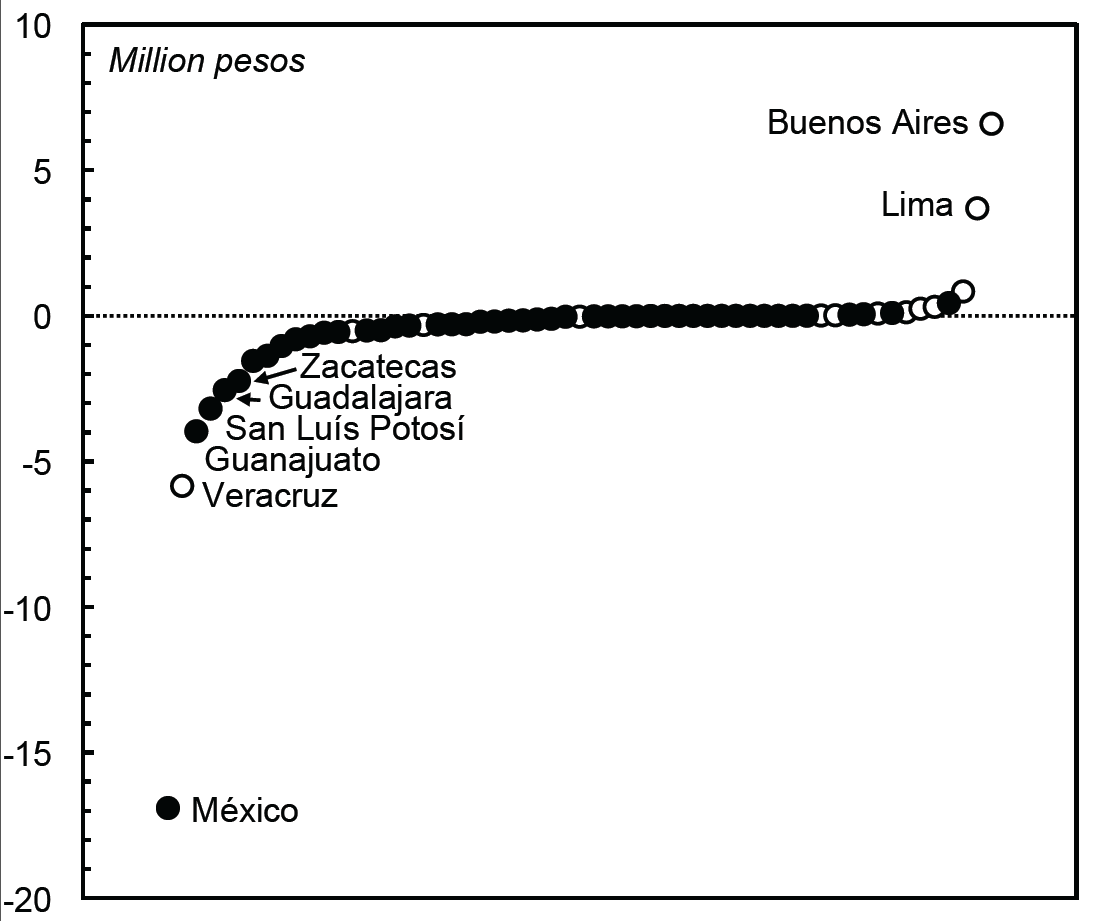

Grafe and Irigoin’s data on net intra-colonial transfers are shown in Figure 1 for the 59 treasuries included in their 1785-89 sample. The treasuries run from México City, with a net outflow of 16.9 million pesos, to Buenos Aires at the other extreme, with a net inflow of 6.6 million pesos. All the treasuries that Grafe and Irigoin probably classified as ports are shown as hollow dots.

Figure 1: Net Intra-Colonial Transfers in Spanish America, 1785-89

Note: Probable ports are indicated by hollow dots.

Source: Grafe & Irigoin 2006, pp. 264-65, Table 3.

Buenos Aires and Lima (actually Callao) immediately stand out as the two ports that took the lion’s share of transfers, so it is worth considering their cases in detail.

Lima was one of the two main trading hubs of the Spanish Empire for much of the colonial era. It benefitted from the trading monopoly, which ensured that all trade between Europe and South America had to go via the city. In setting up this system, the crown’s goal was to ensure that American silver flowed back to Spain in exchange for European goods that were sold in the Americas at vastly inflated prices. Problems arose, however, when Lima’s creole merchants began to sell cheaper American-made goods, thereby reducing South America’s dependence on imports. The crown responded by establishing the Viceroyalty of the River Plate in 1776, which sought to undermine Lima’s merchants by allowing direct trade between Buenos Aires, the new viceregal capital, and Spain. Silver from the mines of Upper Peru was then redirected away from Lima toward Buenos Aires, where there was little in the way of local manufacturing to satisfy the demand for goods, which grew as silver arrived. Hence, even though the funds transferred to the Buenos Aires government were predominantly spent locally, they were spent on imported goods, so ultimately most of the silver was remitted back to Spain by private merchants.1 The port was just an intermediate point in the flow of silver from the mines of Upper Peru to Europe, much as Lima once had been, and even then continued to be, although to a lesser degree.

The problem with Grafe and Irigoin’s argument is therefore that they ignore the extractive role of the ports in the Spanish Empire. Silver came to be remitted to Spain less as public funds – the flow studied by Grafe and Irigoin – than as private remittances in exchange for imported European goods that could be sold at hugely inflated prices due to the way in which the trade monopoly prevented competition among merchants. Hence, trade itself was a means by which silver was extracted from the empire. Indeed, it was the principal means: the treasuries studied by Grafe and Irigoin (2006, p. 251, Table 1) remitted 11.8 million pesos to Spain during 1785-89, while private merchants imported approximately 116 million pesos of American bullion during the same period (Cuenca Esteban 2008 p. 349, Appendix Table 5). By promoting trade, intra-colonial transfers thus facilitated the extraction of American resources by private merchants.

References

Acemoglu, D., and J.A. Robinson (2012), Why Nations Fail: The Origins of Power, Prosperity, and Poverty, London.

Cuenca-Esteban, J. (2008), ‘Statistics of Spain’s Colonial Trade, 1747–1820: New Estimates and Comparisons with Great Britain’, Revista de Historia Económica, 26:3, pp. 323-54.

Engerman, S.L., and K.L. Sokoloff, (2012) Economic Development in the Americas since 1500: Endowments and Institutions, Cambridge.

Grafe, R., and M.A. Irigoin (2006), ‘The Spanish Empire and Its Legacy: Fiscal Redistribution and Political Conflict in Colonial and Post-Colonial Spanish America’, Journal of Global History, 1:2, pp. 241-67.

_____ (2008), ‘Bargaining for Absolutism: A Spanish Path to Nation-State and Empire Building’, Hispanic American Historical Review, 88:2, pp. 173-209.

Halperín Donghi, T. (1982 [2005]), Guerra y finanzas en los origenes del Estado argentino (1791-1850), Buenos Aires.

North, D.C., W. Summerhill, and B.R. Weingast (2000), ‘Order, Disorder and Economic Change: Latin America Versus North America’, in B. Buenos de Mesquita and H.L. Root, eds., Governing for Prosperity, New Haven, pp. 17-58.

Footnotes

- There must, incidentally, be considerable inaccuracies in Grafe and Irigoin’s data source. It shows, for instance, that there were not remittances from the Buenos Aires treasury to Spain, yet Tulio Halperín Donghi’s (1982) detailed investigation into the Buenos Aires accounts has indicated that such remittances were substantial. Similarly, Grafe and Irigoin suggest that there was little net outflow from Upper Peru, so where exactly did Buenos Aires’ inflows come from? It seems unlikely that they came all the way from New Spain! ↩

Very nice post.

My own eyebrows started to rise when you said that Grafe and Irigoin were using a regression analysis–surely a concept as simple as extraction of precious metals doesn’t need the apparatus of regression, with all its baggage of controls and their problems, assumptions about the error term, etc..

I mention this simply because I wonder whether one victory of the Acemoglu -Robinson school is that its critics feel they have to engage them in their wilderness of instruments (bishop deaths as proxies for mortality, etc.) and unit roots, when there might be some very simple measures and correlations (the glorious Thirteen Colonies trade with British Caribbean islands, for example) that could to useful work in knocking down some of the props behind what Branko Milanovic called the A-R model of “Wikipedia entries with regressions

PS. Didn’t know about the Cuenca-Esteban paper, so thank you very much as well.

Pingback: The Terms of Trade and (Under)development in the Long Nineteenth Century | Joe Francis

So according to the authors today the United States is being exploited by the rest of the World as it pays for real imported goods and services with dollar deposits. Your analysis is inconsisten with Modern economic thingking. The fact was: the Americans wanted real goods from the rest of the World, the rest of the World wanted silver currency from America. Both sides were better off. I recommend this video: https://www.youtube.com/watch?v=vW3J5LBVfGc